For over 2 years, the COVID-19 Economic Injury Disaster Loan program provided funding to help small businesses recover from the economic impacts of the COVID-19 pandemic. In that time, over 3.9 million loans totaling over $378 billion were approved across the country. In Northern Ohio, the Small Business Administration approved over 40,000 loans totaling more than $1.8 billion to be used as interim working capital and for other normal operating expenses.

The program effectively ended the first week of May 2022. As of May 6, the SBA was no longer processing COVID-19 EIDL loan increase requests or requests for reconsideration of previously declined loan applications due to a lack of available funding.

As of May 16, the COVID-19 EIDL portal closed. Borrowers who need copies of their loan documents can still contact Customer Service at (833) 853-5638. Please allow at least 5 business days to receive your materials.

So, What Comes Next?

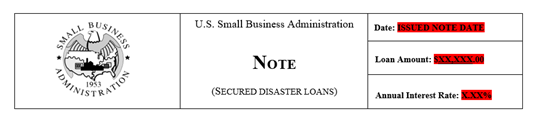

Payments were automatically deferred for 30 months from the date of the Note. SBA began approving COVID EIDL applications in Spring 2020. This means we are rapidly approaching the end of the deferment period for those early loans.

Business owners should start preparing to make payments. Here are some important items to note:

- Interest continued to accrue on the loans during the deferment.

- Partial or full payments were being accepted during the deferment but were not required.

- Deferments may result in balloon payments.

Monthly payments of principal and interest will begin at the end of the deferment period and will be paid over the remaining 27+ years. For borrowers that received loan increases, the deferment period began on the first disbursement. You may make prepayments at any time without penalty.

To check account balances and payment due dates:

- Visit the Capital Access Financial System (CAFS) website: https://caweb.sba.gov.

- Instructions on how to set up a CAFS account is found at: CAFS_Borrower.pdf (sba.gov)

- If you need further technical assistance, please contact the CAFS’s Helpdesk at 833-572-0502 or [email protected], Mon.-Fri. 8 a.m. to 8 p.m.

- For Non-Profit Borrowers, please call the loan’s assigned Servicing Center to ensure an authorized user has permissions to set-up and access the organization’s CAFS account.

Payment options: There are several options to make a payment to SBA

Make an online payment at Pay.gov (PREFERRED):

- Go to https://www.Pay.gov.

- Search for SBA Form 1201 Borrower Payment.

- Submit payment using SBA Form 1201 Borrower Payment using one of the following accepted online payment methods: bank account (ACH), PayPal account, debit card

- Instructions on how to make your electronic payment visit, SBA Borrower Payments (link: https://qa.pay.gov/agencydocs/docs/sba.pdf)

- Add U.S. Small Business Administration as a payee on your personal online banking account.

- Enter your 10-digit loan number as the “Account Number.” Note: your loan number is not the same as your application number. Loan numbers are listed on your account statements.

- If you need to enter a payment address, enter P.O. Box 3918, Portland, OR 97208-3918. If you need to enter a telephone number, enter the telephone number found on the front of your statement.

- Set up an electronic one-time or recurring payment using your bank’s bill pay service.

- Make payments by check or money order, payable to the “U.S. Small Business Administration.”

- Enter your 10-digit SBA loan number in the memo field on your check or money order.

- Mail your payment to: U.S. Small Business Administration, P.O. Box 3918 Portland, OR 97208-3918

- Business Name

- Borrower’s Name

- Borrower’s Address

- Account Number

- Tax ID/EIN or SSN

- 10-digit SBA Loan Number

Borrowers should review their loan authorization to ensure all terms are being followed. For loans above $25,000, SBA filed a lien on the business assets. If a business owner wants to sell a piece of equipment or the business itself, SBA will need to approve the release of its lien. In some cases, this may require a cash payment to reduce the loan balance. These requests are approved by one of SBA’s disaster loan centers and borrowers should be prepared to make their request well in advance of the actual sale.

Most EIDL borrowers in Northern Ohio may contact SBA’s servicing center in Birmingham at (800) 736-6048, Hours: 7:30 a.m.-4:00 p.m. CT, Monday through Friday. Borrowers can also contact the Birmingham Disaster Loan Servicing Center through [email protected].

Additional Servicing Information may be found here:

If you have additional questions or require further assistance specific to your COVID EIDL Loan, please call our Disaster Customer Service Center at (833) 853-5368 (Monday through Friday from 8:00 am to 8:00 pm, Saturday and Sunday from 8:00 am to 8:00 pm Eastern Time) or email us at: [email protected].

For Federal Text Telephone (TTY) services, users can access Telecommunications Relay Service (TRS) to make TTY calls by dialing 7-1-1.

For Video Relay Services and Video Remote Interpreting, users may use any National VRS Provider available via the Federal Communications Commission (FCC) at no cost to users or federal agencies.

A list of Providers can be found at www.fcc.gov/vrs-providers .

Additional Resources:

SBA continues to offer other funding options for small businesses including traditional SBA loans. Information can be found at: https://www.sba.gov/funding-programs. In addition, we have a tool called Lender Match which may assist you in finding an SBA lender: www.sba.gov/lendermatch.

The SBA Northern Ohio District Office works with a network of Resource Partners across the state that may be able to assist with business continuity support and/or may be aware of more local resources. You can make an appointment with any of our SBA Resource Partners for free one-on-one counseling and mentoring.

- Toledo SBDC at the Toledo Regional Chamber of Commerce

- Ohio Small Business Development Centers: Ohio SBDC

- Find Your SCORE Chapter: Find Your Business Mentor | SCORE

- For general inquiries or questions, please feel free to contact the SBA Northern Ohio District Office at (216) 522-4180.

RSS Feed

RSS Feed